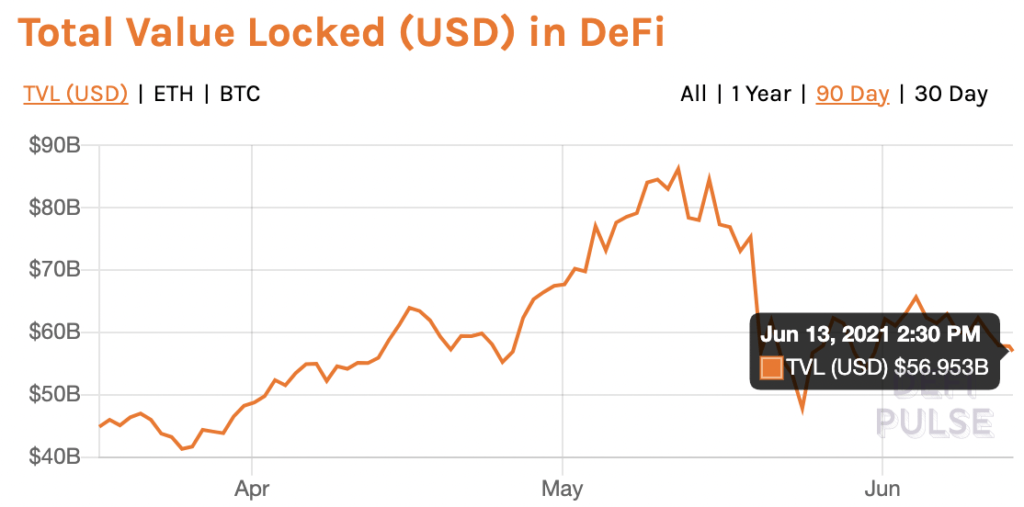

Despite millions being wiped out by the price drop of altcoin projects, the overall crypto market cap still stands at over $1.5 trillion. Bitcoin continues to trade above the $35,000 level and DeFi projects with high market caps are starting to recover. Despite the overall decline in the total locked figure (TVL) in DeFi, we see an increasing influx of investment.

DeFi-focused Altcoin Projects Show Promise

There are various metrics that support price signals such as TVL and blockchain. Few of these turn out to be price catalysts. First of all, while TVL is a key component for the overall growth of DeFi ecosystem components, it is not considered a complete metric on its own to support a narrative.

The price of DeFi projects is largely dependent on external factors such as correlation with Bitcoin and social media activity. According to Ekta Mourya, other projects related to decentralized exchanges (DEXs) and lending protocols are on the rise, as the governance-focused use case covers several key projects. Some of the key metrics are the number of active users, transaction volumes on decentralized exchanges, annual interest in lending protocols, amount deposited in lending protocols, and amount of outstanding loans. In the past two months, projects such as UNI, CRV, YFI reached their local peaks before the first week of May. The exceptions are SUSHI, RUNE, AAVE, and SNX, which were higher before the crash on May 19.

Following the sale on May 19, most of the leading DeFi tokens are experiencing more than 60% drop in price and market value. Enzyme, Strike and Cream Finance rallied in the 60-day period. These are DeFi projects with a low market value and a low user base compared to other high-end projects.

What Do Investors Care About?

Uniswap V3 is more efficient than V2, but can be further increased in value. Traders care about downside protection, not just price hits and maxes. During a bull market, more traders care about prices rather than transaction fees. In a bear market, protocols offer high returns to keep traders in a bear market. The current rally also inevitably supports the bullish narrative.