The leading crypto has dropped from its peak of $ 69 thousand at the end of last year to $ 18 thousand this year. This left Bitcoin miners in a very difficult situation as production did not cover the costs. On the other hand, though brutal, fluctuations in mining profitability are stripping the network of unprofitable operations and weak miners who can’t stand the volatility.

Miners sell their Bitcoins and exit the system

As you follow on Kriptokoin.com, Bitcoin’s highly volatile price has devastated most of the crypto market. Now it’s taking the miners down with it. Although often thought of as the foundation and most resilient players of the Bitcoin network, miners suffer from rapidly declining profit margins.

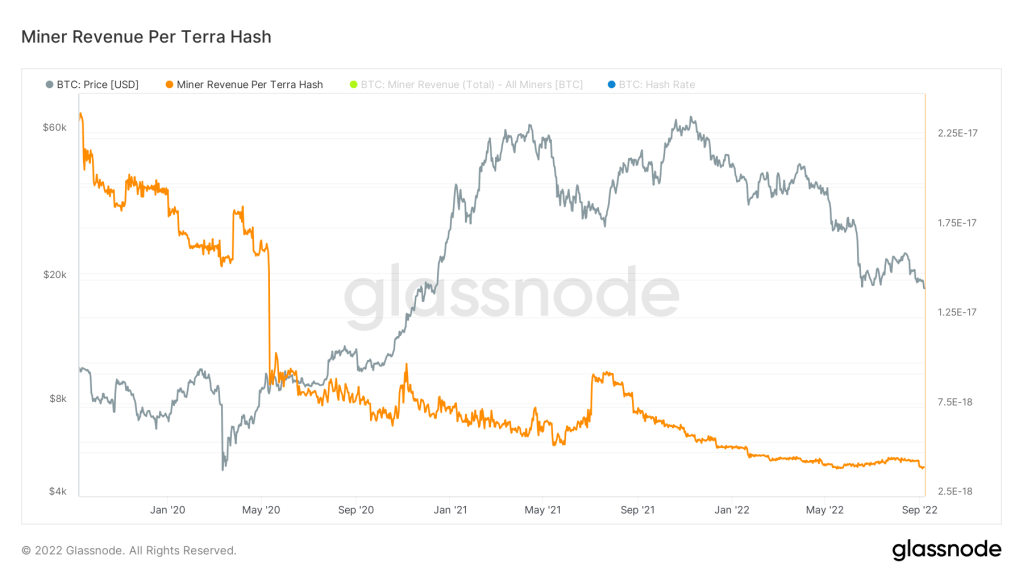

Bitcoin mining difficulty is currently just 1% below its all-time high. That’s why it removes a large percentage of miners from the network. Mining profitability, mining revenue per terra hash dropped below $5,000 in early September. This indicates that it is about to reach one of its lowest points.

Miner’s revenue per terra hash / Source: Glassnode

Miner’s revenue per terra hash / Source: GlassnodeBitcoin miners face increasing mining difficulty and decreasing profitability. Therefore, miners had to sell their BTC holdings en masse. The total supply of Bitcoin held at miner addresses peaked at 1.84 million BTC in July. Since then, miners have sold over 12,000 BTC.

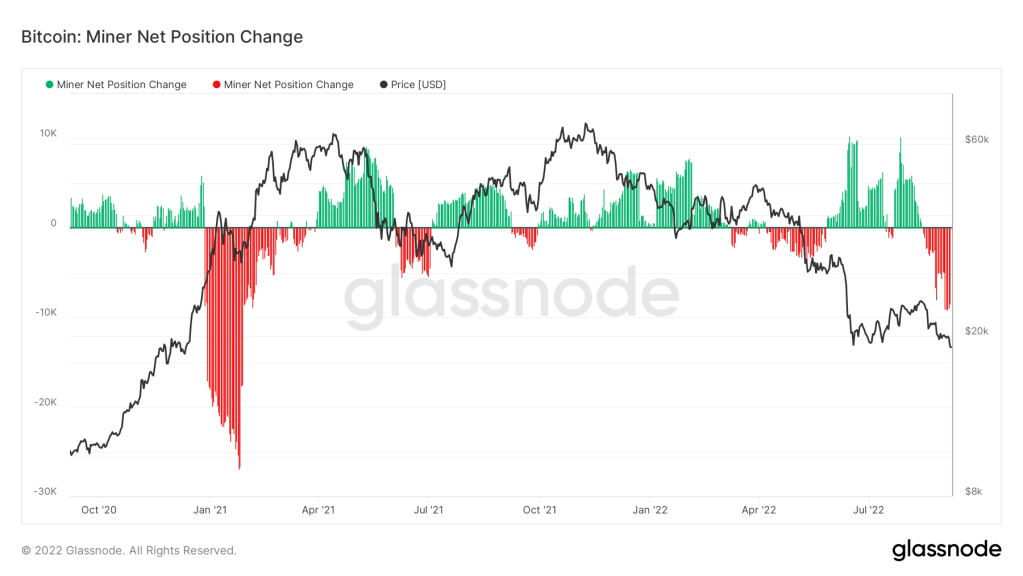

Bitcoin hit an all-time high of $69k in November 2021. Data from Glassnode showed that a similar capitulation took place back then. At that time, miners sold about 30,000 BTC. An even bigger sell-off is possible in the coming weeks if miners follow a similar pattern throughout the fall.

30-day change of BTC supply held at miner addresses / Source: Glassnode

30-day change of BTC supply held at miner addresses / Source: Glassnode“Big sale could be really good for Bitcoin in the long run”

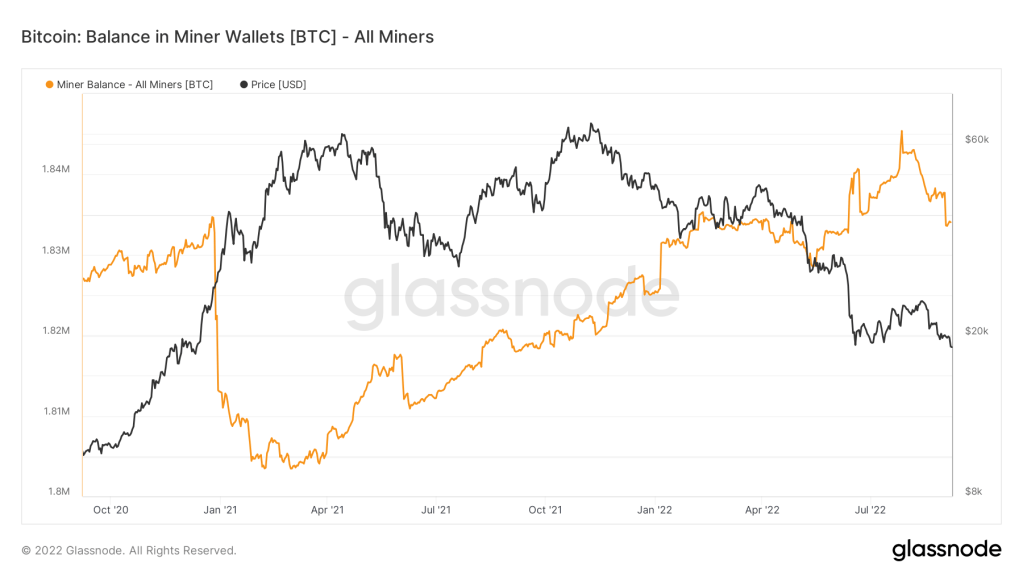

Meanwhile, Hash Ribbons shows that the worst surrender is over. Also, shrinking miner balances paint a different picture.

Bitcoin balance in miner wallets / Source: Glassnode

Bitcoin balance in miner wallets / Source: GlassnodeHowever, according to experts, the big sell-off we’ve seen in the last two months could be really good for BTC in the long run. While brutal, fluctuations in mining profitability are keeping the network free of unprofitable operations and weak miners who can’t stand the volatility. Once the market stabilizes, the Bitcoin network will rest on the shoulders of the most resilient and profitable miners. This in turn will strengthen them for future cycles and volatility.