As Bitcoin (BTC) option open positions reach a record level, the interest of institutional investors is also increasing.

Bitcoin options open interest has reached an unprecedented milestone, rising to $20.5 billion as of today. This remarkable success indicates that institutional investor participation in the cryptocurrency industry is on the rise. Unlike futures contracts, BTC options come with predetermined expiration prices, providing valuable information about investors’ expectations and markets’ sentiment.

At the forefront of the Bitcoin options market is Deribit, which has an impressive market share of 90 percent. The stock market currently has a significant open interest of $2.05 billion for options expiring on January 26. However, it is worth underlining that there may be great volatility in these options as we get closer to January 26. However, bullish options, previously set aside in anticipation of regulatory approval for a spot exchange-traded fund (ETF), are coming back into the system.

Detailed information about options surprised!

For now, the $54,000 call option expiring on January 26 is trading at 0.02 BTC, which is equivalent to $880 at current market prices. This option requires a 25 percent increase in the value of Bitcoin over the next 49 days for the buyer to profit. It is noteworthy that sellers can hedge their positions and reduce some of the perceived risk associated with this trade by using BTC futures while earning income from the option premium.

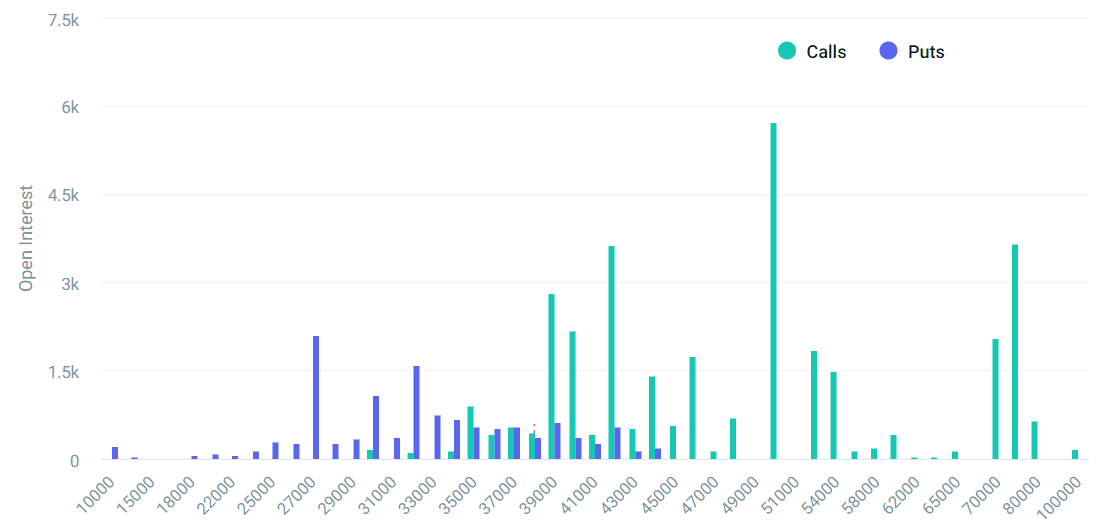

Analysts highlighted the $250 million open interest on Deribit resulting from $50,000 worth of call options. The total value of these options, with a current price of $44,000, is $8.8 million. This valuation could see significant growth if regulators give the green light to spot ETF plans. But it remains unclear whether buyers of these $50,000 call options intend to use them for bullish strategies.

Relatively modest demand for call options in the $70,000 to $80,000 range, accounting for less than 20 percent of open interest, indicates a lack of enthusiasm among bulls. These options, which have a risk of $285 million, are currently worth only $1.2 million. By comparison, open interest on $60,000 and $65,000 call options expiring on December 29 is $250 million.

Turning to put options, investors seem to be prepared for the end of January. 97 percent of options are at $42,000 or less. Unless the current price trend undergoes a significant reversal, the $568 million open interest in put options could face bleak prospects. However, selling put options could offer investors a means to gain upside exposure to Bitcoin above certain price levels, although the exact impact remains difficult to predict.