Bitcoin (BTC) price continues to fluctuate below $40k. With the Fed president’s speeches last night, activity started in the crypto money market. The market in general spent January 27 with decreases that did not reach double digits. Let’s take a look at analysts’ forecasts for the critical technical levels ahead. Micheal Van de Poppe of Twitter is our first analyst…

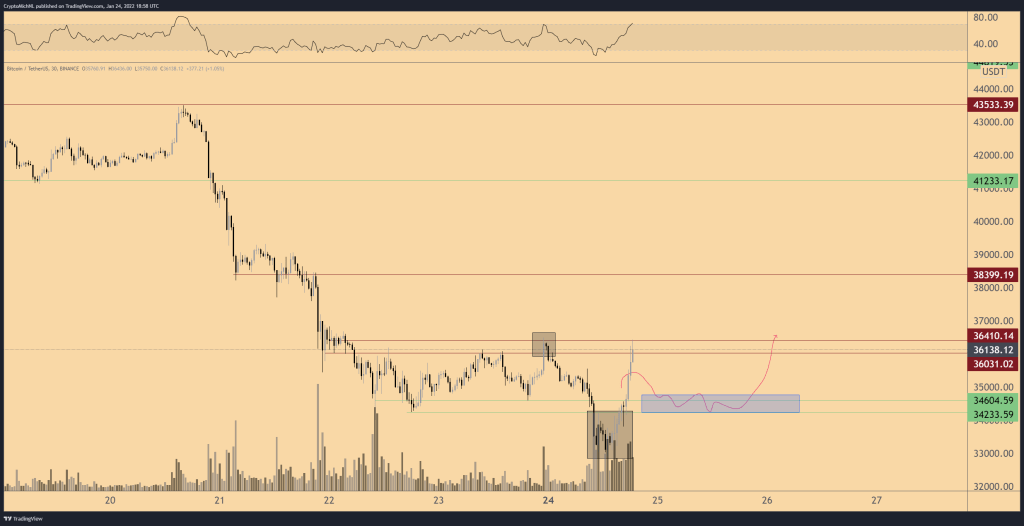

Bitcoin prepares to defend the $35,800 resistance

In a recent strategy session, Micheal Van de Poppe said that he believes the bottom of Bitcoin has not yet arrived, even though BTC has bounced from its 90-day low of $32,990,. In his statements, the analyst underlines that although Bitcoin has not yet formed a firm base, BTC bulls can still ignite a relief rally:

In this case, the level to watch for BTC is $35,800. We jumped from here. However, if we fail to break $36,500 at this stage, a test of $34,000 looks likely… However, if we break above $36,500 and maintain this $35,800 level, this will increase the upside momentum.

As for the analyst’s bounce target, Van de Poppe says Bitcoin could reach the $40,700 resistance:

Bitcoin’s great move. It’s ready for testing at $38,000 and possibly $4,700 after the series retracement.

BTC fell to $ 33 thousand on January 24

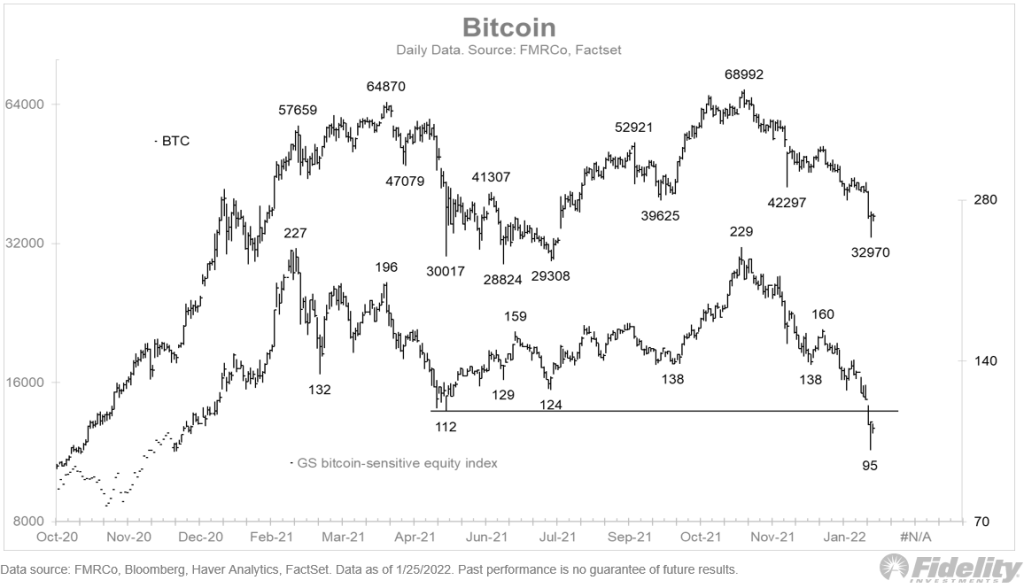

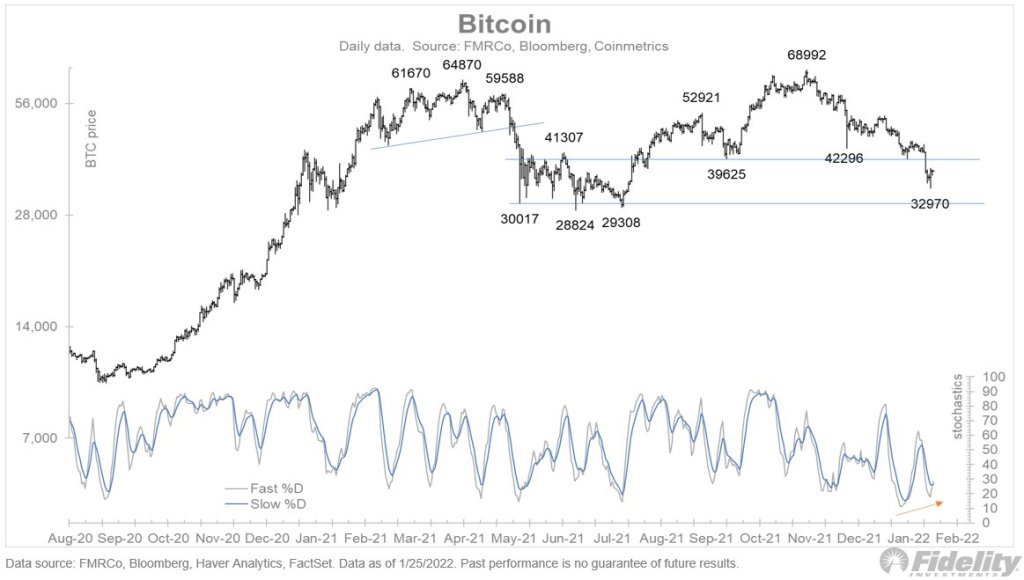

Jurrien Timmer, macro strategist at finance giant Fidelity, said in his recent Twitter analysis that he was surprised that Bitcoin did not stay at $40,000 after the ATH level dropped steadily above $69,000 in November:

Glassnode’s basket of Bitcoin-sensitive stocks has already hit 2021 lows. Based on my demand model and on-chain dynamics, I thought $40,000 would be the bottom, but we’re at $35,000.

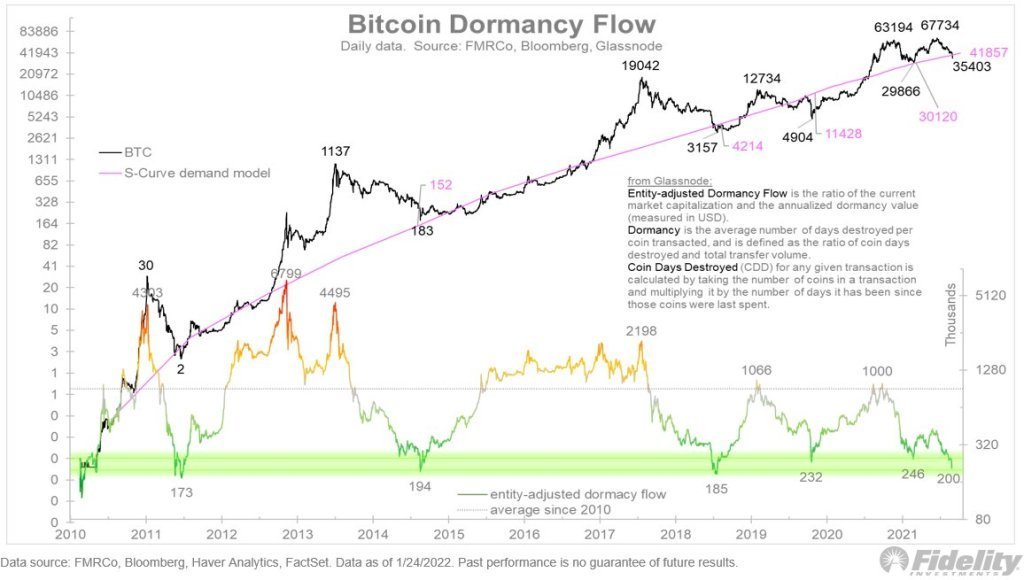

Next, referring to past trends where weak hands surrendered to strong hands, Timmer sees the potential for Bitcoin to reverse course and rise once again:

Bitcoin often transcends ups and downs, so maybe that’s all that’s going on here. Here is the ‘presence-adjusted sleepiness flow’ that measures the transition from weak hands to strong hands. It is in the range that has stopped every previous drop.

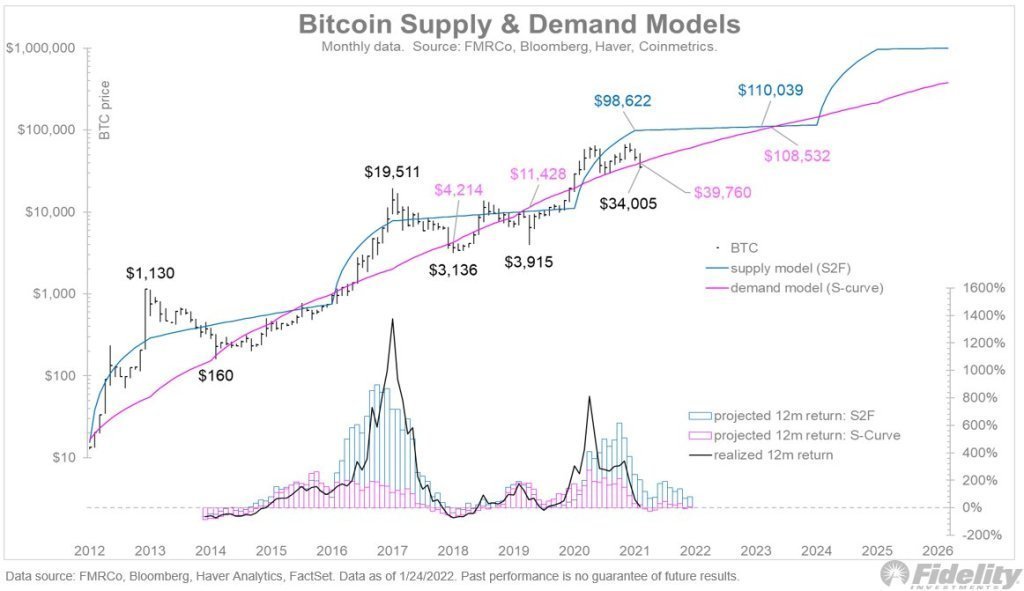

The analyst says the following regarding Bitcoin (BTC) supply and demand:

The lower Bitcoin falls, basically the lower it will be valued.

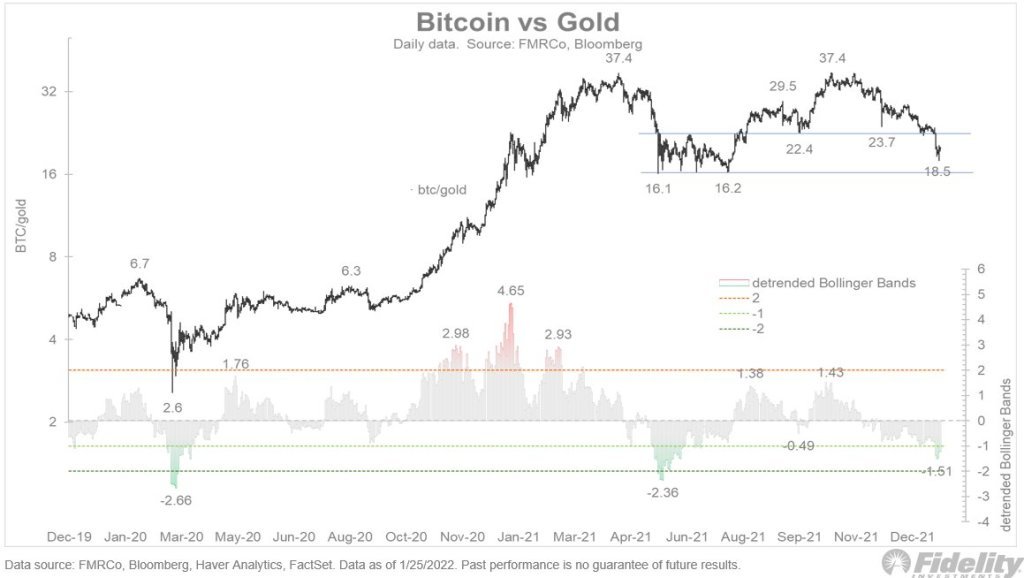

Timmer also highlights that the Bitcoin-gold ratio has “returned to the support zone and is 1.51 standard deviations from the trendline.”

The strategist shares his latest chart as an indication that “short-term momentum is now showing an uptrend.”

Timmer concludes his analysis by saying that although Bitcoin has gone through a rough journey that has seen speculative stocks crumble as well, BTC’s strong fundamentals remain intact:

Bitcoin has clearly been caught in a liquidity storm that is currently sweeping the more speculative side of the stock market. But unlike for-profit tech stocks, Bitcoin has a fundamental foundation that will likely become more attractive over time. Now that the liquidity tide is returning, fundamentals should be more important than ever in 2022.